The Single Strategy To Use For Pacific Prime

Insurance policy likewise helps cover costs related to liability (lawful responsibility) for damage or injury caused to a 3rd event. Insurance coverage is a contract (plan) in which an insurance provider indemnifies one more versus losses from certain backups or perils. There are many sorts of insurance coverage. Life, health, home owners, and car are amongst the most usual types of insurance policy.

Investopedia/ Daniel Fishel Many insurance policy types are offered, and essentially any individual or business can locate an insurance coverage firm prepared to insure themfor a price. Many individuals in the United States have at least one of these types of insurance coverage, and vehicle insurance is called for by state regulation.

Our Pacific Prime Diaries

Locating the price that is right for you calls for some research. Maximums might be established per duration (e.g., yearly or plan term), per loss or injury, or over the life of the plan, additionally recognized as the lifetime optimum.

There are numerous various kinds of insurance policy. Wellness insurance helps covers routine and emergency situation clinical care expenses, usually with the alternative to add vision and oral solutions separately.

Numerous precautionary services may be covered for totally free before these are fulfilled. Wellness insurance coverage might be acquired from an insurance policy company, an insurance agent, the federal Health Insurance Marketplace, offered by a company, or government Medicare and Medicaid protection.

The 7-Minute Rule for Pacific Prime

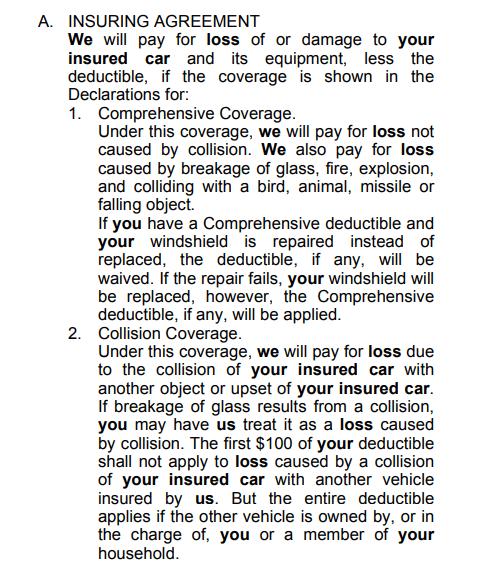

The company then pays all or many of the covered expenses connected with an automobile accident or various other lorry damage. If you have actually a rented vehicle or obtained money to acquire a car, your lending institution or renting dealership will likely need you to carry auto insurance policy.

A life insurance coverage plan assurances that the insurer pays an amount of cash to your recipients (such as a partner or children) if you die. There are two main kinds of life insurance coverage.

Insurance is a way to handle your financial risks. When you purchase insurance coverage, you acquire protection against unforeseen monetary losses.

The Single Strategy To Use For Pacific Prime

There are lots of insurance coverage policy types, some of the most usual are life, health and wellness, house owners, and car. The right type of insurance for you will depend upon your objectives and financial situation.

Have you ever had a minute while looking at your insurance policy or looking for insurance policy when you've believed, "What is insurance policy? And do I truly require it?" You're not the only one. Insurance coverage can be a mystical and puzzling point. Just how does insurance job? What are the advantages of insurance policy? And just how do you locate the very best insurance policy for you? These are typical inquiries, and luckily, there are some easy-to-understand solutions for them.

Enduring a loss without insurance coverage can place you in a hard financial scenario. Insurance policy is an essential economic tool.

The Single Strategy To Use For Pacific Prime

And sometimes, like auto insurance and employees' payment, you might be called for by read this post here regulation to have insurance in order to secure others - global health insurance. Discover ourInsurance options Insurance coverage is basically a gigantic nest egg shared by lots of people (called insurance policy holders) and managed by an insurance coverage service provider. The insurance provider uses cash gathered (called costs) from its insurance holders and various other investments to pay for its operations and to accomplish its assurance to insurance holders when they submit a claim